IRS W2C DOWNLOAD

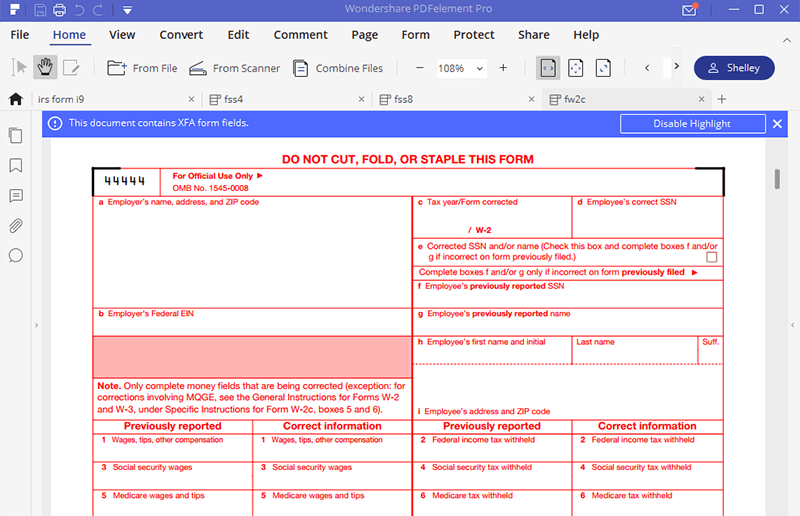

You are expected to file the Form w-2C form as soon as you discover the error on the original W-2 form. That means on line 1, you are expected to write down the previously reported wages, tips and other compensation writing on the incorrect form and then write the correct one of wages, tips and other information on the form. Simply create a Yearli account, enter or import your data, review, update and validate your data, then checkout. Like mentioned earlier, filling out the IRS Form W-2c is not difficult especially if you follow the step by step guide below. The download should begin automatically.

| Uploader: | Daizilkree |

| Date Added: | 4 November 2007 |

| File Size: | 11.17 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 96593 |

| Price: | Free* [*Free Regsitration Required] |

It is not platform dependent as it functions properly in both the Windows and Mac Platforms.

About Form W-2 C, Corrected Wage and Tax Statements

Price also includes federal e-file, state reporting where applicablerecipient print and mail. While there may be other ways of filling out the W-2C form, the best solution is the ever reliable PDFelement.

Besides, it is an all in one solution that can solve your PDF problems at a reasonable cost. What Our Customers Are Saying 4. All these are expected to be filled for both the previously filed information and the corrected version. Form W-2c corrects errors on previously filed W-2 and W-2c forms. W-2c should not be used for corrections to the W-2G form.

Yearli | Form W-2c

Then write your first name, initials and last name on h. You are expected to fill in the previously reported information and the correct information in the space provided. Employers who need to make corrections to a previously filed W-2 or W-2c form must submit Form W-2c with the accurate information. Thanks for choosing a trial of PDFelement.

How to Fill it Wisely. The information requested here is the employer's state ID number, the state wages w2f tips etc and the state income tax. Then check the box on e and complete box f and g if it is incorrect on the form you have filled previously.

For each information requested on lines 1 to 8, you will have to report the previous information and the correct information.

Like mentioned earlier, filling out the IRS Form W-2c is not difficult especially if you follow the step by step guide below.

We'll file your forms to the IRS, applicable state agency and send copies to your recipients. Ids line 14, see other instructions.

What To Do If Your W-2 is Incorrect or You Don't Receive It

This is because PDFelement form filling capabilities is second to is. This means that you have to fill your previously reported social security number and the name you used initially on f and g respectively. The last is the locality correction information. What to report Corrections to information filed previously on form W-2 or W-2c. Skip and Download Skip and Download. Estimate Your Filing Cost Number of forms.

Do not file a W-2c form to correct only the address. Greatland Yearli is the support staff I don't have and makes it easier to file my 's. This is indeed a capability rear in other form fillers.

I am a self-employed consultant, sometimes hiring others to work with me. Note that this information must q2c captured both as previously reported and as corrected information.

If it doesn't, please click Skip and Download Skip and Download. W-2c Form W-2c corrects errors on previously filed W-2 and W-2c forms. Open the form with PDFelement and begin filling it out using the program. Write your employers name, address and the zip code on column a. That means on line wc, you are expected to write down the previously reported wages, tips and other compensation writing on the incorrect form and then write the correct one of wages, tips and other information on the form.

Failure to do so could result in penalties.

Comments

Post a Comment